virginia military retirement taxes

Find A Dedicated Financial Advisor. Legislation to permit the withholding of state income taxes from military retirement pay has recently been enacted by Congress as part of the 1985 Department of Defense Authorization Act.

Wait Is Military Retirement Pay Taxable Or Not Article The United States Army

3247 into law on May 13 exempting all military retirement income from South Carolina taxes beginning.

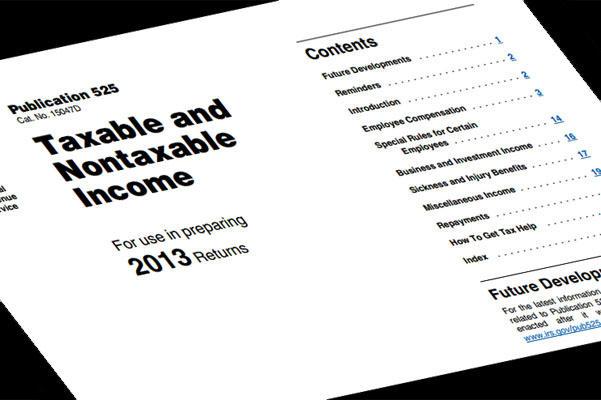

. Under this new federal legislation military retirees would be able on a. Additional 5000 deduction on their state taxes if the Adjusted Gross Income from their federal return is 82000 or less. Yes No Did you receive any non-military income from Virginia sources before you retired from the military.

This subtraction will increase each year by 10000. For example if your. Start Your Taxes And File For Free.

The estimated cost of giving vets that 40000 tax break on their retirement benefits is about a quarter of a billion dollars each year. According to the Virginia Department of Revenue Military Retirement is taxable and is included in gross income on the return. Henry McMaster signed H.

That the Governor and General Assembly support changes to the current Virginia tax laws for a partial exemption of military retirement. Out of the 50 states in this great union 9 states do not have a personal income tax 22 states do not tax military retirement pay 16 only tax a portion of it only leaving 3 states that fully tax military retirement pay California Vermont and Virginia. Box 1475 Richmond VA 23218 804-786-2211 Email the Secretariat.

Delaware - Up to 2000 of military retirement excluded for individuals under age 60. It also provides seniors with a deduction of up to 12000 per year against all other forms of retirement income. Non-military income from Virginia sources might include an off-base non-military job business rental income etc.

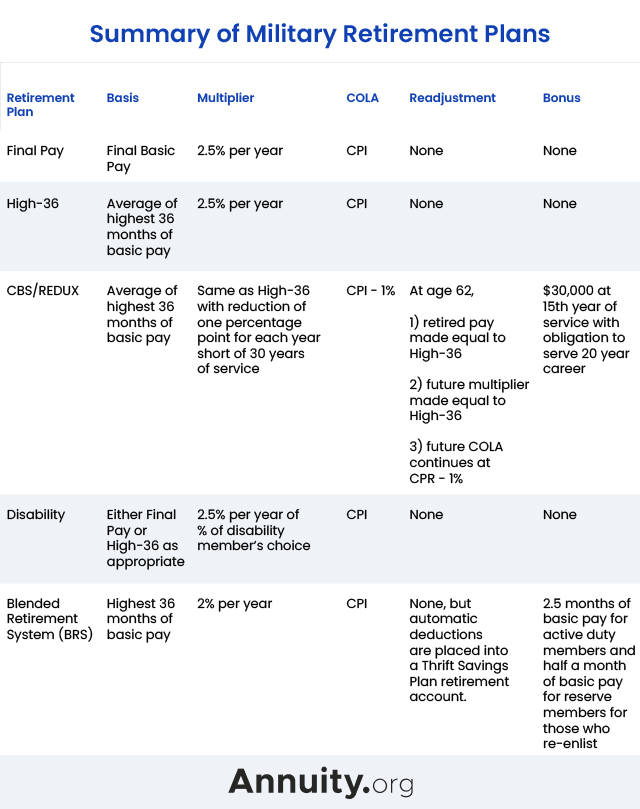

Latest on Grassroots Work to Exempt Military Retirement. A military retiree under the age of 65 may subtract 2500 and 5000 for those 65 years old from federally adjusted gross income that is less than 82000 before determining Virginia tax. After 2022 retirees will no longer be able to deduct retirement from income when filing taxes.

However military retirement income received by individuals awarded the Medal of Honor can be subtracted from. They can currently deduct 75. For taxable years beginning on and after January 1 2 023 but before January 1 2 024 up to 30000 of military benefits.

Beginning in 2022. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Seniors who rely solely on Social Security and other retirement income totaling less than 12000 do not.

State Tax Update. Commonwealth of Virginia Constituent Services PO. The maximum amount of the subtraction.

Beginning with your 2022 Virginia income tax return you may be able to claim a subtraction for certain military benefits. For every 100 of income over 15000 the maximum subtraction is reduced by 100. According to legislation passed last May in Nebraska everything a military retiree receives after retirement will be tax-free starting in 2022 as the deduction from gross income will rise to 100.

Subtraction for military retirement income. Virginia has a number of exemptions and deductions that make the state tax-friendly for retirees. Up to 15000 of military basic pay may be exempted from Virginia income tax.

Beginning with 2022 Virginia income tax returns you may be able to claim a refundable credit equal to 15 of your federal Earned Income Tax Credit EITC. Georgia - Taxpayers over 62 or permanently disabled may be eligible for an exclusion. Ad Life Is For Living.

TurboTax Is Taking Care Of Those Who Serve. To help make that possible we are working diligently to eliminate taxes on the first 40000 in military retirement pay Nearly 3500 Virginians regain voting rights The list. This applies to a military pension received while the retiree is a Virginia resident regardless of where the military retiree was stationed.

12500 if 60 or older. That the Governor and General Assembly support changes to the current Virginia tax laws for a partial exemption of military retirement pay to reduce state tax on military retirement income. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Withholding of Virginia Income Tax from Military Retirement Pay. And for taxable years beginning on and after January 1 2024 up to 40000 of military benefits. For the 2022 tax year Veterans age 55 and over who are receiving military retired pay can deduct 10000 from their Virginia taxable income.

Lets Partner Through All Of It. For taxable years beginning on and after January 1 2022 but before January 1 2023 up to 20000 of military benefits. It exempts all Social Security income from the state income tax.

Ad Free TurboTax Online for Enlisted Active Duty Reserves Military. Build Your Future With a Firm that has 85 Years of Investment Experience. It would be limited to military retirees who are at least 60 and would shield up to 20000 from income taxes - half as much as the House.

State Lawmakers Have Taken Action To Help Veterans And Congress Is Seeking To Follow Suit

Combining Retirement And Disability Compensation Military Com

These States Don T Tax Military Retirement Pay

Moaa State Tax Update Latest On Grassroots Work To Exempt Military Retirement

These Five States Just Eliminated Income Tax On Military Retirement

Military Retirement And Transition Services

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Virginia Retirement Tax Friendliness Smartasset

Do You Have To Report Va Disability As Income For 2022 Taxes Hill Ponton P A

Two More States Stop Taxing Military Retired Pay Military Com

Virginia Military And Veterans Benefits The Official Army Benefits Website

Can You Receive Va Disability And Military Retirement Pay Cck Law

8 Of The Best States For Military Retirees 2022 Edition Ahrn Com

State Tax Information For Military Members And Retirees Military Com

Tax Breaks For Disabled Veterans Military Com

Virginia Military And Veterans Benefits The Official Army Benefits Website

These Five States Just Eliminated Income Tax On Military Retirement